The Evolution of the Tax Professional Starts Here

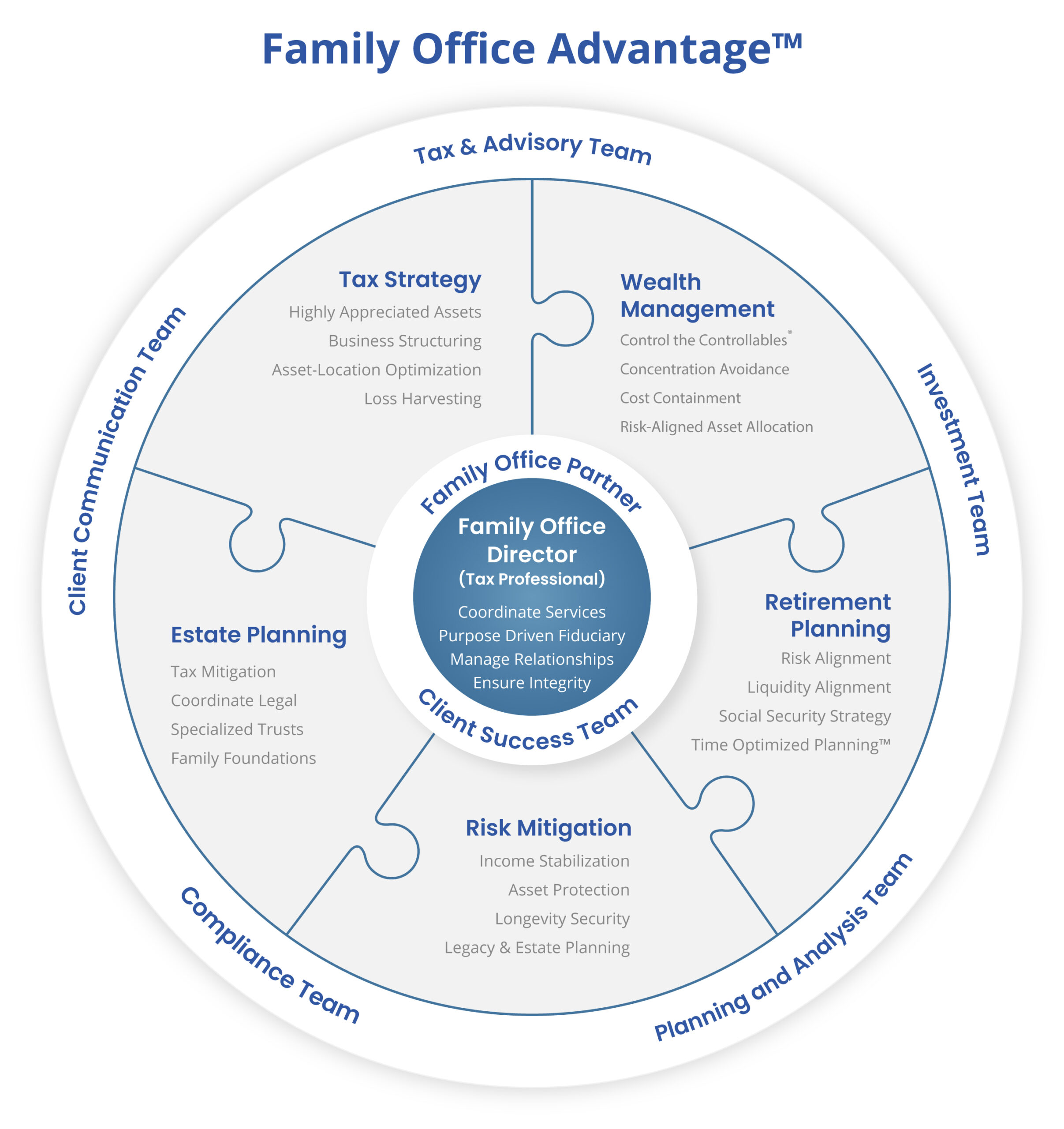

Financial Gravity Companies Inc., along with its subsidiary companies, provide investment and tax professionals with a Turnkey Multi-Family Office Charter. We help tax professionals evolve from the commoditized business of tax compliance to a Family Office Director that runs and manages their own multi-family office. Family Office Directors are able to leverage the Financial Gravity systems, technology, proprietary resources, and deep domain expertise to bring an elevated and holistic financial service experience to their clients that spans proactive tax planning, retirement and estate planning, wealth management, and risk mitigation.

Family Office Director

Our Turnkey Multi-Family Office Charter provides tax professionals a full complement of family office services for their clients. We provide marketing, operational support and infrastructure. Watch the video and listen to our Family Office Directors share their success stories in their own words.

“Must read” is an overused phrase—but not applicable here. The threat from the commodification of tax compliance services is dwarfed by the opportunities that will come from the democratization of the family office. Pick your preferred medium (or media) for reading this book, but it’s critical you get this information. Your first-mover advantage is waiting for you.

You’ll get access to multiple versions of the book:

- Interactive digital book

- Audiobook

- E-book

- Hardcover edition

Are You Ready to Evolve From a Tax Professional to a Family Office Director?

Direct your own Multi-Family Office. Satisfy your clients. Increase your revenue. Build enterprise value.

Latest Articles

Latest Press Releases

From Tax Prep to Family Office Director

The Multi-Family Office is the ultimate expression of the tax pro’s trust, training and talent. We will help you build and manage a Multi-Family Office, eliminating the barrier of entry to this lucrative market.

Turnkey Multi-Family Office Charter

Integrated tax, risk management, and investment solutions to provide your clients with an authentic family office experience.

Evolve From Compliance to Advisory

Your bespoke Success Map will guide you from tax professional to Family Office Director.

Done-For-You Partnership

Deep subject matter expertise and robust infrastructure to maximize productivity and success.

Business Development Solutions

A dedicated marketing department with turnkey and perpetual emails, videos, webinars, a website, and a newsletter built to drive client trust and engagement.

Do More

Convert the bond of trust into a holistic position of authority that puts you in the center of your client’s entire financial world.

Be More

Direct the right resources and subject matter expertise to solve complex problems in investment and risk management while providing forward-looking, sophisticated, tax-centric leadership.

Have More

Enjoy a sustainable practice with delighted clients, reoccurring revenue with unlimited potential, in a relationship of a true fiduciary.